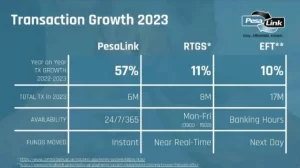

Pesalink experienced notable year-over-year growth during 2022-2023, demonstrating a clear preference for real-time digital payments among users. Transactions from account to account (A2A) surged by 57% in 2023, totaling KSH 6 million moved through Pesalink.

Additionally, the volume of Real Time Gross Settlement (RTGS) transactions increased by 11% within the same timeframe, reaching a total of KES 8 million. RTGS transactions are available from 9 AM to 3 PM, Monday through Friday. Exchange-Traded Funds (ETFs) saw the highest cash movement, with KES 17 million transacted and a growth rate of 10% in 2023.

Pesalink’s analysis, in collaboration with partner banks and fintech companies, revealed a strong consumer demand for instant, digital, and direct account-to-account transactions, available around the clock without significant hurdles.

The preference among Kenyans for financial technologies that offer immediate access, minimal intermediaries, and lower costs is driving the popularity of A2A transfers, which are accessible even outside of standard banking hours.

Owned by the Kenya Bankers Association, Pesalink was launched in 2017 as a real-time interbank transfer system designed to facilitate seamless money transfers between individuals and bank accounts without intermediaries.

Despite Pesalink’s impressive growth, its transaction figures are modest when compared to M-Pesa’s. According to the audited results for the financial year ending March 2023, Kenyans transacted an astonishing Ksh.35.86 trillion through M-Pesa.

Related

African E-Commerce giant, Jumia compounding losses even after order gains.

It’s important to note that M-Pesa offers a broader range of services than Pesalink, including merchant payment options. Pesalink’s announcement of an upcoming merchant payment solution, intended to compete with Safaricom’s Lipa na M-Pesa, is promising news for Kenyans, especially considering recent reports that suggest a decrease in M-Pesa usage due to high transaction costs.