The Kenya Revenue Authority (KRA) has unveiled a strategy to track down and address the issue of traders who have shifted from mobile money payments to cash transactions as a means to circumvent their tax obligations.

In recent weeks, KRA observed a significant number of businesses, including those that previously relied on Lipa Na M-Pesa, reverting to traditional cash-based payment methods.

This shift raised concerns, especially since the tax authority recently intensified its compliance checks in major urban centers.

KRA’s efforts to boost tax compliance involves various measures, including the deployment of around 1,400 revenue service assistants equipped with paramilitary training.

This team is focused on enhancing tax adherence among traders and facilitating the online registration of businesses.

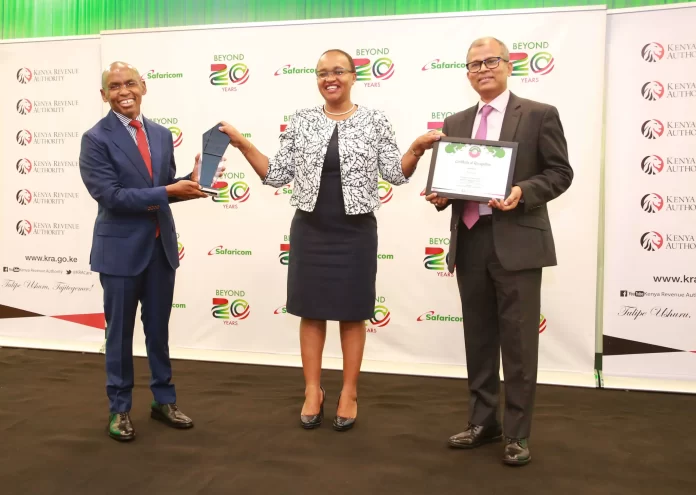

During a recent Media Lab session in Nairobi on Tuesday, October 17, Chief Manager of the Domestic Tax Department, Caroline Rotich, disclosed that KRA is collaborating with Safaricom to identify businesses that have ditched Lipa na M-Pesa.

“Many businesses are now closing Lipa Na M-Pesa merchant accounts, Buy Goods and Pochi La Biashara Tills. We are collaborating with Safaricom to get information on such traders who are jeopardising tax compliance measures.

“We will also facilitate integration and do follow-ups once we have the information to enhance compliance through our RSA programme,” Rotich said.

This partnership is part of the broader strategy to ensure that tax obligations are met and to eliminate potential tax evasion practices.

These initiatives are geared towards maintaining a fair and effective taxation system that supports the nation’s growth and development while discouraging any form of tax malpractice.

𝐊𝐑𝐀 𝐌𝐞𝐝𝐢𝐚 𝐑𝐨𝐮𝐧𝐝𝐭𝐚𝐛𝐥𝐞: 🧵

Today we held a round table, with different media stakeholders sensitizing them on the Tax Amnesty programme which was rolled out 1st September 2023.#ChapaResetNaAmnesty #TaxAmnesty2023 pic.twitter.com/lqG8N5qXL9

— Kenya Revenue Authority (@KRACorporate) October 17, 2023

Safaricom’s Lipa Na M-Pesa Buy Goods Till has gained significant popularity among small traders in recent years.

This service provides them with a convenient platform to receive payments through their till, simplifying the process of settling various expenses like employee wages and commissions.

Roysambu trader explains why Lipa Na M-Pesa is falling out of favour with merchants

While speaking to this writer, a trader in Roysambu stated that many businesses are shunning Lipa Na M-Pesa due to increased charges.

She noted that since last week, Safaricom has been deducting some fees from every transaction that a customer makes.

She even gave an example, stating that she noticed that Sh9 was deducted after a customer paid Sh1,000. Furthermore, she expressed concern that additional charges would be incurred when a merchant withdraws the money in their till.

While explaining why people are ditching M-Pesa services, she pointed out that the challenging economic conditions have forced traders to take such measures in order to survive.

KRA raises Sh3.4 billion from Tax Amnesty Programme

Caroline Rotich officially confirmed that over 17,000 taxpayers have taken advantage of the tax amnesty program, which commenced on September 1, 2023.

“More than 17,000 taxpayers have applied for the tax amnesty which commenced on 1st September, 2023, and we expect the number to immensely grow as we continue to create awareness amongst taxpayers,” said Rotich.

The number of applicants is expected to grow significantly as efforts to create awareness among taxpayers continue.

𝐊𝐑𝐀 𝐌𝐞𝐝𝐢𝐚 𝐑𝐨𝐮𝐧𝐝𝐭𝐚𝐛𝐥𝐞: 🧵

Today we held a round table, with different media stakeholders sensitizing them on the Tax Amnesty programme which was rolled out 1st September 2023.#ChapaResetNaAmnesty #TaxAmnesty2023 pic.twitter.com/lqG8N5qXL9

— Kenya Revenue Authority (@KRACorporate) October 17, 2023

Kenya Revenue Authority (KRA) has identified a staggering 2.8 million taxpayers who have incurred penalties and interest, making them eligible for participation in the tax amnesty program.

This initiative provides qualified taxpayers with a unique opportunity to have penalties and interest automatically waived for the specified period, without the need for a formal amnesty application.

By implementing the program, KRA aims to provide substantial relief to taxpayers while recovering outstanding dues and promoting compliance with tax regulations.